In a new series of insights from our award-winning debt recovery team, our legal experts set to answer some of the most commonly asked questions surrounding commercial debt collection and debt recovery.

If you have any other debt related questions which are not answered here, or you would like to submit one of your own questions to be included in our next issue of FAQs, please contact us and a member of the team will reply back to you as soon as they are available.

1. Does a customer have the right to withhold payment if I do not have a valid purchase order number?

Simply put, the answer is no. A purchase order (‘PO’) is used solely by a purchaser and has no impact on the service/goods provided to them. It is usually an internal accounting requirement that you have no control over.

Companies often rely upon the requirement of a purchase order as a defence to non-payment, but this is not a legal defence. If a purchase order number is provided at the time of booking the service/goods, it should be used on the related invoice, but where the customer fails to provide you with this information, you cannot be expected produce one out of thin air, it would be impossible. If an order is validly placed and agreed, a purchase order number is no basis for non-payment.

A similar argument is also used when payment of late payment compensation and interest is requested. Due to the very nature of these charges arising out of statute, no invoice is produced but many companies refuse to make a payment without an invoice. Again, this is not a legal defence; the sums are due by statute.

2. What does it mean when the sole trader debtor is in a debt relief order?

A debt relief order (‘DRO’) can be an effective way for sole trader debtors who have a relatively low level of debt to have the same amount written-off. The debts included in a DRO are frozen so interest cannot be added and the debtor does not make any repayments for a year. If your debtor’s situation has not changed in the year, the debts included are written-off.

A DRO is, in essence, a low-cost alternative to a debtor taking formal bankruptcy but it still appears on the insolvency register. To qualify for a DRO, the debtor must meet the following criteria:

- Total debts of less than £20,000;

- Not be a homeowner;

- Own less than £1,000 in assets, which includes a vehicle; and

- Have less than £50 surplus income at the end of a month.

The debtors who will make use of this are individuals and sole traders who have not been able to make a success of their small business. For obvious reasons, customers that qualify for a DRO should not be allowed much, if any, credit terms.

3. Can a debt be recovered if a limited company is no longer trading?

If a company owes you money then you may not be able to recover this debt if the company has ceased trading. A company may remain in existence because the directors have ceased to trade but have not taken a route to formally dissolve the company. If a company is dissolved, it no longer exists and therefore debt cannot be recovered.

Just because the company is no longer trading it does not necessarily mean that there are no assets. Careful consideration should be given to how far you pursue a company if you have the knowledge it is not trading. If it has recently ceased to trade, there is more chance of available funds to pay the debt. However, if there are no assets then instigating winding up proceedings is your only option. This may result in the directors being investigated but will also be expensive and unlikely to result in any recoveries for you.

4. What is the best method of enforcement to try?

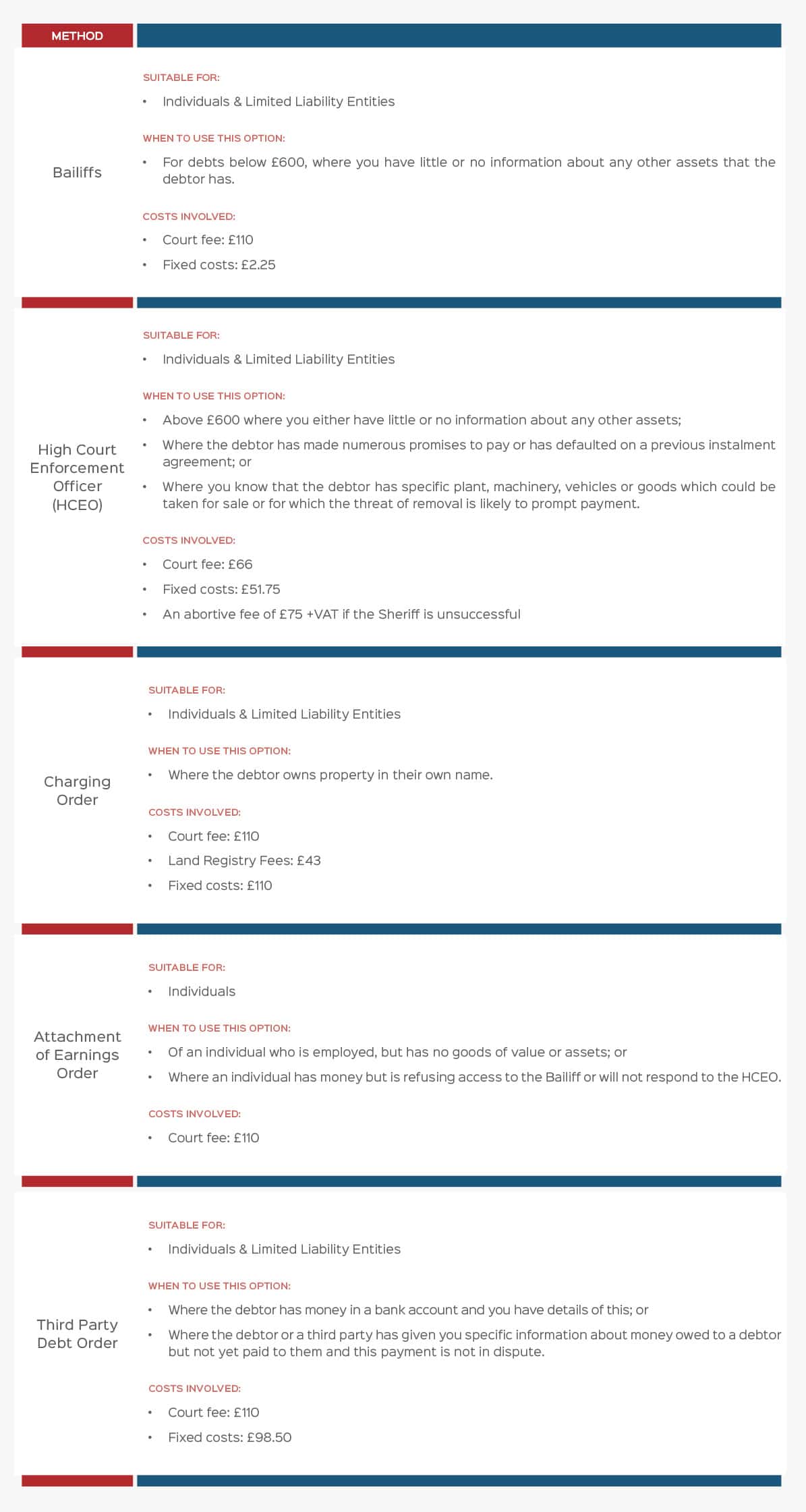

It really comes down to the size of the debt and the nature of the debtor. There are numerous options available, so it is not all about agents attending where if the debtor “cannot pay, they take it away!” Below is some useful guidance on particular enforcement methods that can be used:

5. How much does it cost to issue a claim?

The cost to issue court proceedings depends on the value of the debt which may include any late payment compensation (applicable for commercial debt) and interest which has accrued.

The economics of issuing a claim should be considered with low-value debt as the costs incurred in proceeding with a claim could easily out-weigh the debt value. However, you may still choose to proceed despite the cost implications out of principle to maintain your reputation.

If a solicitor is issuing a claim on your behalf, you will be entitled to claim for fixed costs from the defendant. There is also a recoverable fixed cost when you enter judgment which you can claim, again if a solicitor is bringing the claim. The amount of fixed cost that can be applied is dependent on the debt value, much like the court fee. The table below outlines the court fees and fixed costs depending on the debt value.

Still got a question

If you still have a question that you would like answering, contact our Debt Recovery team using the form below.